Things are getting from bad to worse for Private Credit giant Blue Owl Capital.

The last time we looked at the firm’s precarious liquidity situation about a month ago, we found that the Blue Owl BDC would allow for 17% redemptions as investors, burned by both the tumbling stock price and the company’s massive exposure to ticking private credit time bombs, were storming for the exit.

Blue Owl BDC Allows for 17% Redemptions as Investors Storm Exit: BBG

— zerohedge (@zerohedge) January 7, 2026

One month later, it has gotten far worse.

On Wednesday, Blue Owl Capital said it will fully restrict withdrawals from one of its retail-focused private credit funds, reversing a previous plan to resume redemptions this quarter as furious investors, fearing many more cockroaches are about to emerge, demanded their money in droves.

The New York private credit firm said that investors in Blue Owl Capital Corp II, known as OBDC II, will no longer be able to redeem shares on a quarterly basis. Instead, the gated fund will return capital through periodic distributions funded by loan repayments, asset sales or other transactions.

On Wednesday, Blue Owl said it sold about $1.4 billion in direct-lending investments across three funds: Blue Owl Capital Corp II, Blue Owl Capital Corporation, and Blue Owl Technology Income Corp. The buyers included North American public pension funds and insurance companies.

According to Bloomberg, the decision to gate capital highlights the risks confronting retail investors entering the fast-growing private credit market. Though investors are generally allowed to redeem a portion of their capital each quarter, payouts can be curtailed if withdrawal requests exceed set limits.

OBDC II drew scrutiny in recent months after Blue Owl proposed merging it with a publicly traded vehicle — a transaction that prior disclosures indicated could have resulted in losses of roughly 20% for some investors. The company promptly reversed the decision following investor outcry, but that did not change anything in the underlying business and redemption requests had already exceeded the standard 5% quarterly cap.

“OBDC II has been exploring options to either create a liquidity event for investors or wind down the legacy vehicle and ultimately return capital to shareholders. We believe this is an important step forward for the fund as it creates an efficient process around returning capital to these investors,” wrote a Citizens Financial Group analyst, adding that selling loans at par was a “win-win.”

Blue Owl initially looked to sell loans at OBDC II and then widened to other vehicles following demand from institutional buyers, the firm said. OBDC II sold about $600 million — roughly 34% of its portfolio — and will use the proceeds to repay a credit facility from Goldman Sachs, and make a special cash distribution that will total about 30% of the fund’s net asset value.

It has been a very bad year for private credit funds in general and Blue Owl in particular which has been flooded with redemption requests in the past year: funds that let investors redeem periodically can face pressure when too many people want their money back at once. Managers often keep some more easily sold assets to meet withdrawals. Selling directly originated loans, which typically don’t trade often, is less common.

In the most recent quarter, redemption requests exceeded 5% at both of Blue Owl’s non-traded business development companies. Its tech-focused vehicle, OTIC, saw redemption requests jump to about 15% of net asset value, Blue Owl said. As we reported earlier this month, the latest pressure point for Private Credit funds are their investment in Software/SaaS stocks, with fears spiking after a Barclays report revealed huge exposure to the collapsing software sector.

Blue Owl’s largest publicly traded BDC, OBDC, sold about $400 million of loans across 74 portfolio companies at around par, with an average position size of about $5 million. Blue Owl Technology Income Corp. sold roughly $400 million of loans and used the proceeds to pay down debt.

“What began as a targeted transaction to provide liquidity to OBDC II shareholders attracted significant interest from sophisticated institutional investors, allowing us to opportunistically extend the sale to OBDC,” Craig Packer, a co-founder of Blue Owl, said in a press release.

The firm said the transactions improved balance-sheet flexibility, modestly increased diversification and created more room to deploy capital.

Commenting on the latest news ouf of Blue Owl., Goldman’s alt-financials specialist Christian DeGrasse laid out a bullish and bearish take (below we excerpt from his full note available to pro subs)

- Bullish feedback: 1) Positive for the BDCs to be selling loans at/near PAR and combo of delever / buy back stock (OBDC bought back stock at ~86% of book from Nov – Dec), 2) this is a positive ‘proof of concept’ that the marks are in a good place (particularly software, the largest industry in the sale), yes FPAUM getting impacted but with where valuations are, what matters is durability/quality/question of underwriting rather than small movement in mgmt fees

- Bearish feedback: 1) This impacts OWL’s FPAUM and thus there base mgmt. fee & Part 1 fees (the $1.4bn loan sale est impact firmwide rev by ~1% .. though more OBDC II runoff in future could continue to weigh slightly), 2) Views that this is cherry picking the best loans, 3) we don’t know the duration on these loans – credit spreads have mostly tightened over the past few years, shouldn’t these loans be sold at above-par?, 4) this could indicate higher redemptions on the come (the big non-traded BDC OCIC is not participating in the loan sale so not a read through there … but maybe on OTIC?) 5) some are wondering whether OWL’s own affiliates participated (I’m not seeing any facts around this FWIW, just sharing feedback), while 6) this morning we’re getting a lot more inbounds from the macro community about gating redemptions OBDC II (they are saying they’ll return capital through distributions funded by loan repayments, asset sales or other transactions)

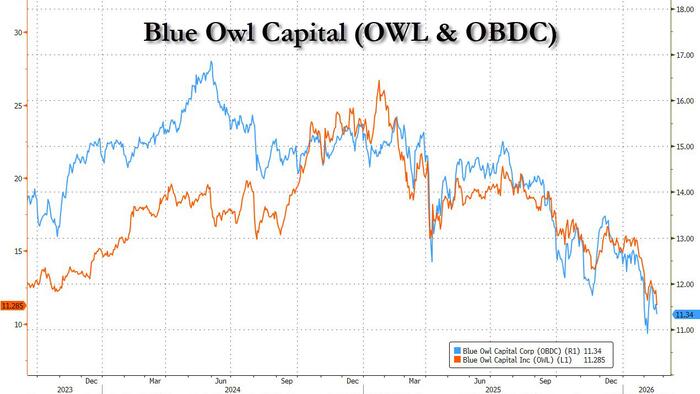

The stock of Blue Owl Capital (OWL) tumbled to a fresh two year low this morning, while the publicly-traded BDC (OBDC) also dumped.

More in the Goldman note available to pro subs.

Loading recommendations…

Read the full article here