There are three certainties in life: death, taxes and China stimulus disappointing.

For the latest example look no further than the plan revealed this morning by the National People’s Congress Standing Committee, which approved a 10 trillion yuan ($1.4 trillion) debt swap package for local authorities to refinance “hidden” local debt onto public balance sheets. Funds for that program – telegraphed last month but without a price tag or timeframe – will be provided through 2028, they said, after the move was authorized by the nation’s top lawmaking body.

The details of the 10 trillion (but really 12 trillion program) are as follows:

- 1) A one-off increase in the 6tn yuan local government debt issuance, over 3 years (2024-26);

- 2) 4tn yuan special LGB issuance under the annual quota, over 5 years (2024-29); and

Additionally, the government will guarantee to pay back 2tn yuan implicit debt related to shantytown redevelopment due in 2029 and after.

In total, according to the Chinese MoF, the implicit local government debt will be reduced from RMB14.2tn to RMB2.3tn, a total of 12tn.

While policymakers didn’t announce measures to directly stimulate domestic demand, Finance Minister Lan Fo’an promised “more forceful” fiscal policy next year, signaling bolder steps – and another round of stimulus – could come after Trump’s inauguration in January. The US president-elect has threatened 60% tariffs on Chinese goods that could decimate trade between the world’s largest economies, and blight exports that have been a rare bright spot for the Asian nation this year.

Putting it together:

- The good news: this should reduce pressures from near-term debt repayment and lower debt-servicing costs, giving local governments more room to execute budgeted spending that’s needed to lift growth up to this year’s 5% target.

- The bad news: this was the bare minimum and came at the very low end of market expectations. That said, some have suggested that Beijing doesn’t want to burn all of its dry powder before it knows what anti-China measures Trump has in stock, so maybe just another reason to wait.

“Policymakers probably saw no need for a robust response to Trump’s victory before he takes office, given the relatively restrained post-election market response,” said Duncan Wrigley, chief China economist with Pantheon Macroeconomics. “Next year is a different matter, but officials will take that as it comes.”

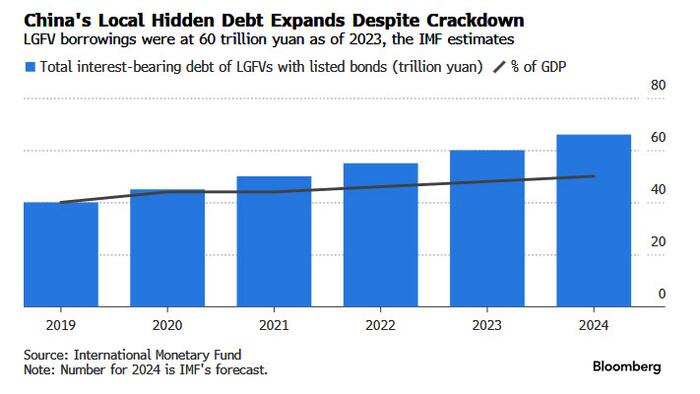

China has labeled local government debt one of the three “major economic and financial risks” facing his country, as regions divert money away from growth-boosting projects to repay their debt. Most of that money is tied to entities known as local government financing vehicles (or LGFVs), which borrow on behalf of provinces and cities to finance investment in infrastructure.

But local authorities have struggled to service those liabilities in recent years as the property crisis wiped out land sales they relied on for revenue. Officials at the briefing said the outstanding value of so-called hidden debt was 14.3 trillion yuan as of the end of 2023, far short of the International Monetary Fund’s estimate of at about 60 trillion yuan.

While markets shrugged off the measures, Lan called the package “a major policy decision taking into consideration international and domestic development environments.” Policymakers also took the rare step of raising local governments’ debt ceiling mid-year for the first time since 2015.

That increase in the debt limit will allow local governments to issue six trillion yuan in additional special bonds over three years to swap hidden debt, Lan said at the briefing. Regional authorities will be able to tap another total of 4 trillion yuan in special local bond quota to be approved in tranches over five years — including 2024 — for the same purpose, he added.

“To really have a positive for markets, you want to see something which is two trillion or above specifically talking about consumption-related stimulus,” Bernie Ahkong, CIO at UBS O’Connor Global Multi Strategy Alpha told Bloomberg TV.

So was this a disappointment?

According to the market – with Chinese stock futures and the yuan both tumbling – a resounding yes, but as SocGen’s China strategist Wei Yao notes, it is more certainty on the forward looking part. Ahead of the meeting, SocGen had wondered if the debt swap could total over RMB10tn over next 3-4 years including the annual bond issuance quota. So the announced plan is slower but not smaller, and the bank didn’t expect the entire package to be clarified today. Then some may argue that the RMB4tn is not “additional”, but this statement can only be true if we had known about the debt issuance plan in the next five years. That is – is the 800bn per year really deducted from an already-set trajectory? No, not even the MOF knows what’s the fiscal package for next year.

The problem is that markets were happy to frontrun all this and more: China’s boldest stimulus blitz since the pandemic had sent onshore shares soaring by about 30% since September, thereby taking the pressure off officials to act immediately, which of course reflexively meant that Chinese stocks would immediately dump – as they did – putting more pressure to act! Those rate cuts, along with stock and housing market support pledges, have put President Xi Jinping back on track to hit this year’s growth goal of around 5%, without taking on piles of extra debt to reflate the economy.

In any case, investors had waited for weeks for the fiscal side of that campaign, with media reports stoking expectations for much more spending to stabilize the property market and boost consumption. Sure enough, disappointment was palpable at the start of the presser, with the offshore yuan weakening as much as 0.6% before paring the decline to 0.3% as the full scale of the package was known.

What is the impact on the economy?

The debt issuance will not fund new measures and the MOF pledges to contain growth in any new LGFV debt. But the swap will free up fiscal resources and allow local governments to function more normally. That is, local government will be much abler to carry out necessary spending, reduce unnecessary fines and penalties, and pay back arrears owed to the private sector.

It remains to see how the issuance schedule will look like. The imminent issuance of RMB2tn LGB to replacement implicit debt, confirmed today, will require liquidity injection worth 100bp RRR cuts. This could also be managed by PBoC’s liquidity operations.

What about stimulus?

Here China’s message seems to be “be patient and to be continued.” Markets were disappointed by the absence of any detail on anything else other than the local government debt. But as SocGen had cautioned, the SCNPC chooses to signal, rather than deliver, a more forceful fiscal budget in 2025. Regarding housing and bank recapitalization, the message today is that it’s being worked out quickly – if not as quickly as markets wanted to see. Indeed, the test of market patience can be problematic for confidence.

Market momentum aside, Beijing’s willingness to act to stop the deflationary spiral is still there, at least this is what Wei Yao is clinging some hope on. But clearly, Beijing wants to do things at its own pace. For one, the 2025 fiscal budget is not for now. The thinking may also be that:

- The economy is showing more signs of bottoming out, and so there is less rush to top up stimulus for 2024.

- There is still so much uncertainty around Trump tariffs – how much and when. Why show all the cards now? Indicatively, raising US tariff rate on Chinese goods from 20% currently to 60% could require RMB2-3tn additional fiscal stimulus to counter.

Then, what’s next?

- The banking recapitalization looks to be a bank-by-bank approach. And so, there should be details coming in the next few months, albeit likely in several batches.

- The 2025 fiscal budget will be the real deal to watch in terms of “additional” stimulus for domestic demand. If one doesn’t want to be disappointed again, then one might better not expect much detail before the year-end or even before March 5th NPC meeting next year. At the moment, we expect RMB2tn in special CGBs issuance (i.e. additionally) in 2025 to support demand, and more if we get to know the tariff plan by March.

Putting it together, Beijing will do what’s necessary to counter tariff shocks and stop deflation at least over the next few years, regardless of the timing of policy announcements, but not at a pace dictated by markets. And while Beijing’s “policy put” is here to stay, Beijing’s patience is tricky for confidence.

Investors will now be looking to December for the next major window for bigger fiscal measures, when the 24-man Politburo will discuss the economy at a monthly meeting and policymakers will huddle at the annual Central Economic Work Conference. By then, officials could have greater clarity on Trump’s stance on tariffs, and more time to devise a fiscal strategy to fireproof the economy.

Officials could still unveil a “meaningful” fiscal package in the near term, according to Xiaojia Zhi, head of research at Credit Agricole CIB. Additional spending of 12 to 13 trillion yuan is possible in the next three years, to offset the impact from aggressive US tariff hikes, she added. That said, by now everyone who has bet on a “bigger than expected” stimulus by China has been badly burned, so it’s safe to assume that going forward the market will no longer react to promises but will instead demand actions.

Loading…

Read the full article here