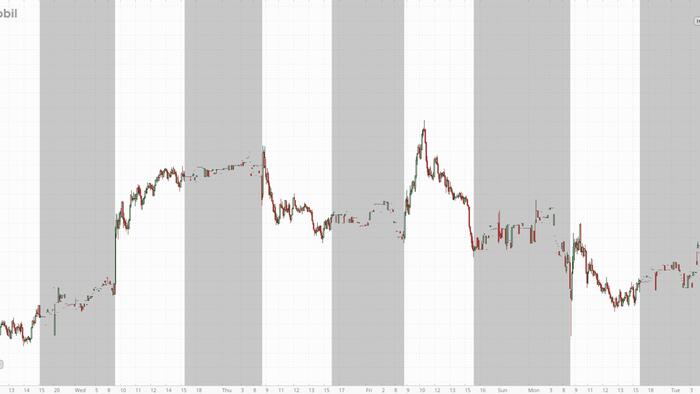

Exxon is trading sharply higher today, rising nearly 4% after the opening bell as investors reacted to a stronger long-term outlook from the company. The oil giant raised its expectations for future earnings and cash flow through 2030, driven by continued growth in its most profitable assets and additional structural cost savings. The update has pushed Exxon shares back toward 52-week and all-time highs, giving positive momentum to one of our favorite names heading into the new year.

In its announcement, Exxon said it now expects $35 billion in cash-flow growth by 2030, an increase of about 17% from what it was projecting a year ago, with no changes to capital expenditure. The company also raised its cost-savings target, noting that savings will rise 10% to $20 billion compared with 2019 levels. These improvements come without raising spending, which suggests stronger operating efficiency, particularly in the company’s upstream business.

Much of Exxon’s confidence stems from its heavy investment in low-cost fields in the Permian Basin and Guyana. Both are profitable at less than $35 a barrel, enabling Exxon to grow production and generate earnings even as other producers struggle with prices near multi-year lows.

Chief Executive Officer Darren Woods emphasized that the company’s investment strategy during periods of skepticism—particularly during the pandemic and the ESG-driven shift away from fossil fuels—has positioned it well for the future. “Our transformation helps ensure that in any future environment, and for decades to come, Exxon Mobil will have an important role and deliver substantial shareholder value,” he said in the statement.

Bloomberg energy analyst Javier Blas wrote on Tuesday that Exxon would also “lower spending in low-carbon businesses (to ~$20 billion over the next five years, down from ~$30 billion)” and that “the company plans to stop for now the construction of several hydrogen facilities.”

“While we’re convinced that low-carbon hydrogen will be required […] the markets and customer-base are developing slowly,” Woods told him.

Exxon Mobil to lower spending in low-carbon businesses (to ~$20 billion over the next five years, down from ~$30 billion). The company plans to stop for now the construction of several hydrogen facilities.

“While we’re convinced that low-carbon hydrogen will be required […]…

— Javier Blas (@JavierBlas) December 9, 2025

Elsewhere production is expected to reach 5.5 million barrels of oil equivalent per day in 2030, 17% higher than current levels and 100,000 barrels a day more than forecast a year ago. Exxon attributed the increase to technology advancements, particularly in the Permian Basin, where new proprietary methods may allow the company to extract far more oil than other shale operators.

The company also plans to bring its Golden Pass natural gas export terminal online in the coming weeks, turning what was once a cheap byproduct into a global revenue source. Additional projections include capital spending of $27 billion to $29 billion in 2026, production of about 4.9 million barrels per day that year, 37% of which will come from the Permian, along with a final investment decision on a low-carbon data center project expected “by late 2026.”

Exxon added that it expects to generate cumulative surplus cash flow of $145 billion through 2030 and for earnings to grow $25 billion by 2030, a compound annual growth rate of 13%, while all 2030 corporate emissions intensity plans will be achieved in 2026.

For long-term shareholders, today’s surge reinforces why Exxon remains one of our favorite names. The company is not only growing production and earnings, it is doing so while keeping spending in check and focusing on assets that generate attractive returns in almost any pricing environment. With shares again testing record highs and investors responding positively to the stronger 2030 outlook, Exxon appears well-positioned for a breakout higher in 2026…

Loading recommendations…

Read the full article here