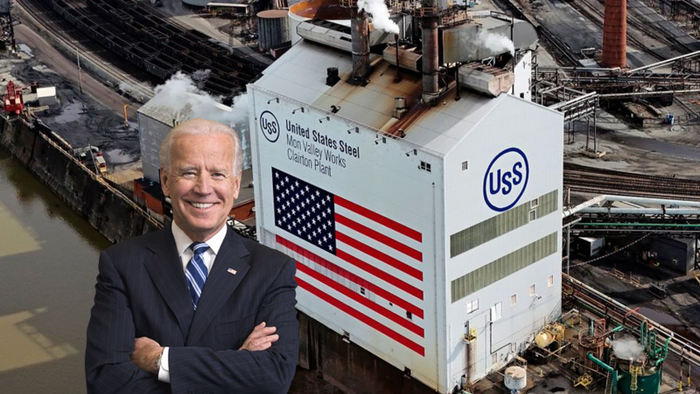

Nippon Steel “Dismayed” By Biden’s Block Of US Steel Deal, Labels It “Clear Violation Of Due Process”

Update (1111ET):

Nippon Steel is furious that President Biden blocked their proposed $14.9 billion deal to take over US Steel.

“We are dismayed by President Biden’s decision to block Nippon Steel’s acquisition of US Steel, which reflects a clear violation of due process and the law governing CFIUS,” the Japanese steelmaker wrote in a press release, adding, “Instead of abiding by the law, the process was manipulated to advance President Biden’s political agenda.”

Nippon said the $55-per-share deal would have revitalized American steel plants with a $2.7 billion investment, protected union jobs, and enhanced America’s steel supply chain against low-cost Chinese competition.

“Blocking this transaction means denying billions of committed investment to extend the life of US Steel’s aging facilities and putting thousands of good-paying, family-sustaining union jobs at risk. In short, we believe that President Biden has sacrificed the future of American steelworkers for his own political agenda,” Nippon continued.

According to Nikkei Asia, the Japanese steelmaker plans to sue the US government, targeting the Committee on Foreign Investment in the United States (CFIUS), which conducted the national security review of the proposed transaction and ultimately influenced President Biden’s decision.

* * *

Update:

President Biden has released a statement indicating that he will “block” Nippon Steel’s $14.9 billion takeover of US Steel.

Here’s the full statement:

As I have said many times, steel production—and the steel workers who produce it—are the backbone of our nation. A strong domestically owned and operated steel industry represents an essential national security priority and is critical for resilient supply chains. That is because steel powers our country: our infrastructure, our auto industry, and our defense industrial base. Without domestic steel production and domestic steel workers, our nation is less strong and less secure.

For too long, U.S. steel companies have faced unfair trade practices as foreign companies have dumped steel on global markets at artificially low prices, leading to job losses and factory closures in America. I have taken decisive action to level the playing field for American steelworkers and steel producers by tripling tariffs on steel imports from China. With record investments in manufacturing, more than 100 new steel and iron mills have opened since I took office, and U.S. companies are producing the cleanest steel in the world. Today, the domestic steel industry is the strongest it has been in years.

We need major U.S. companies representing the major share of US steelmaking capacity to keep leading the fight on behalf of America’s national interests. As a committee of national security and trade experts across the executive branch determined, this acquisition would place one of America’s largest steel producers under foreign control and create risk for our national security and our critical supply chains.

So, that is why I am taking action to block this deal. It is my solemn responsibility as President to ensure that, now and long into the future, America has a strong domestically owned and operated steel industry that can continue to power our national sources of strength at home and abroad; and it is a fulfillment of that responsibility to block foreign ownership of this vital American company. U.S. Steel will remain a proud American company – one that’s American-owned, American-operated, by American union steelworkers – the best in the world.

Today’s action reflects my unflinching commitment to utilize all authorities available to me as President to defend U.S. national security, including by ensuring that American companies continue to play a central role in sectors that are critical for our national security. As I have made clear since day one: I will never hesitate to act to protect the security of this nation and its infrastructure as well as the resilience of its supply chains.

* * *

Biden administration officials seem to have leaked the president’s impending decision, expected on Friday, to block Japan’s Nippon Steel from purchasing US Steel. The Washington Post was the first to report on the president’s planned move.

The report states that two administration officials revealed President Biden chose to block the deal between Nippon Steel and US Steel, despite warnings from some senior advisers about potential negative consequences surrounding future foreign investment in US companies.

On Dec. 23, the Committee for Foreign Investment in the United States, also known as CFIUS, notified the Biden administration it had not reached a consensus about whether Nippon’s potential purchase of US Steel would pose a national security risk, essentially leaving the decision up to the elderly president who doesn’t know what day it is.

The panel, chaired by Treasury Secretary Janet Yellen, said Nippon purchasing US Steel could reduce domestic steel production and pose “risks to the national security of the United States,” adding, “Potential reduced output by US Steel could lead to supply shortages and delays that could affect industries critical to national security.”

CFIUS noted that Nippon’s global operations might not support ‘America First’ amid US Treasury trade actions against low-cost steel imports. They said this could leave “the US economy more exposed to dumping and unfair subsidization of steel.”

On Monday, Nippon executives made a last-ditch attempt to sway Biden. The execs sent a proposal to the White House that would allow the government to veto any reduction in US Steel’s “production capacity.”

For many months, Biden has publicly opposed Nippon’s $14.9 billion takeover of US Steel, ultimately siding with David McCall, the president of the United Steelworkers union. McCall has called Nippon’s bid as “bad for workers.”

Meanwhile, President-elect Donald Trump has opposed the transaction and said he would support US Steel with tariffs and tax incentives.

In premarket trading, shares of US Steel are down 6% in New York.

If Nippon Steel’s purchase of US Steel is rejected due to national security concerns, foreign investors could reconsider allocating resources toward mergers, acquisitions, or investments in the United States.

Loading…

Read the full article here