Starting on Friday, we have seen a sudden reversal from panic-selling to panic-buying in tech stocks, which has lifted Nasdaq back above its 100DMA…

The headline-grabbing culprit for much of the pain to the downside was Software stocks (IGV as an example of an ETF that tracks the sector), which collapsed as specifically SaaS firms faced ‘existential threats’ from AI disruption.

That snapped Software valuations down dramatically…

And, suddenly – starting Friday morning – buyers appeared to snap up these newly cheap stocks…

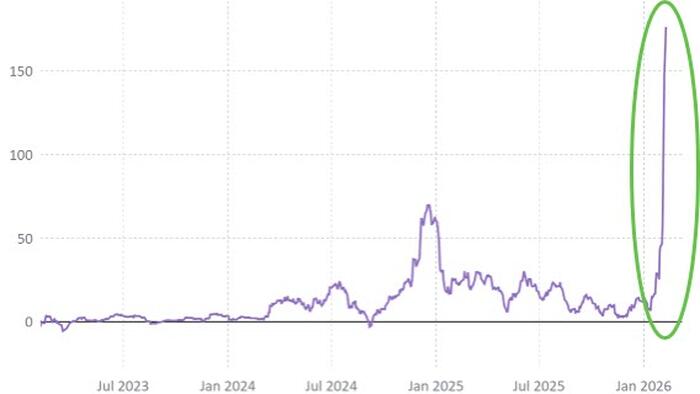

Inflows into IGV – the Software ETF – have soared…

But, the question has been – who’s buying?

Well now we have the answer, thanks to Vanda Research:

1M rolling net retail inflows into the iShares Software ETF (IGV) surged to a record $176mn as of close yesterday, more than double the prior peak seen during the late-2024 software drawdown.

This is one of the more aggressive episodes of retail dip-buying in tech, and especially software, that we’ve observed in our dataset.

Vanda also notes that Amazon ranked as the most bought US stock by retail investors, displacing Nvidia in the last few sessions.

Last Friday, AMZN recorded its largest single-day of net retail buying since Aug 2024.

We also saw decent follow-through buying throughout the session yesterday.

This is in keeping with the theme that retail investors have been opportunistically buying the dip in mega-cap tech after any earnings-driven sell-offs (also seen in MSFT, GOOGL etc.).

The question is – can retail maintain this momentum long enough to get hedgies re-engaged in Software from their near-record low exposure levels

Loading recommendations…

Read the full article here