By Peter Tchir of Academy Securities

For most of our readers, the days are starting to get longer! The shortest day of the year is behind us! That is unequivocally good news, unless you are a vampire.

On top of that, there is some hope that the annual shift in Daylight Saving Time (that makes it dark early), will be changed! I think that is good news for many, but it is uncertain to occur.

Which brings us to the real question, what will D.C. be like in the coming months and what will it do for markets?

As we advocated for on Friday, I think We Need to Pay Attention to the Budget Debate This Time.

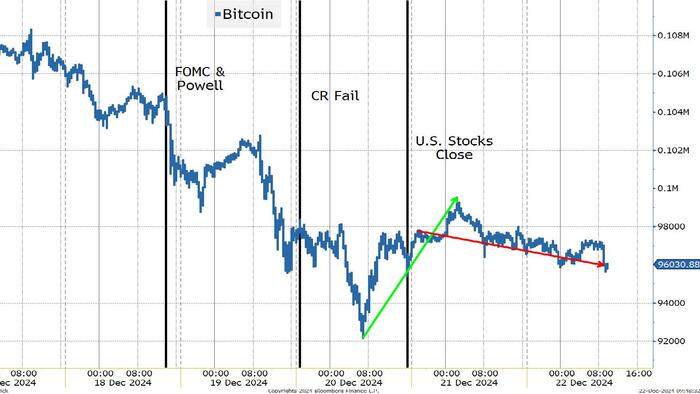

Stocks (and crypto) rallied strongly from overnight lows as it became apparent that a new path forward was being presented that was likely to pass. I guess that there was “relief” that a shutdown would be averted, but I think what is important (going forward) is how things played out, because that might give us an indication of what can be accomplished in the coming months.

A simplistic view is:

-

A very long budget (continuing resolution) was proposed, with very little time to read, let alone debate, the provisions.

-

Largely through social media, an uproar was created, resulting in a much shorter CR, with far fewer appropriations, being submitted for a vote.

-

That vote failed and markets sold off overnight.

-

There was chatter about splitting the CR into 3 things to be voted on separately, but in the end, it looks like only one small CR (in terms of number of pages) was voted on and passed.

Stocks have not been open since the CR was passed, but Bitcoin has been. Normally I refrain from using Bitcoin as a guide to anything (because it is often illiquid and volatile), but I think it is useful in this case.

Crypto wasn’t directly affected by the shutdown (it is 24/7, global, etc.), so I think that at least some of the downward price action can be linked to “sudden” concerns about the ability to get pro-crypto policy through (like the Bitcoin Strategic Reserve, which I think is crazy, but it could happen given the power and donations of many of the proponents for such a plan). We wrote about that in detail in The Genius of Mariah Carey.

Now that something has passed, I would have expected crypto to respond more aggressively. It might still do so, but I think that the price movement highlights a couple of concerns about the budget debate that we all need to be thinking about for broader markets.

- On Twitter, where you can find a lot of detail on “issues” with the original/long CR, it seems that the “algo” isn’t highlighting details on the new/smaller CR. It is easy to find stories about how small the final CR (that got passed) is, but there is very little on the details. And what you can find on the details seems to raise as many questions as answers. Without a doubt, Twitter highlighted issues with the original, in some level of detail, but it now seems to only feed through information about the much smaller document. It seems weird to me, and might be part of why Bitcoin isn’t rallying, because this wasn’t a “clean” win or a strong indication of change in D.C.

- Every Democrat voted for the plan and it was only Republicans who voted against it. That does seem slightly weird, especially when linked to the point above. If it was a huge “win” and a sign of change, why did the voting turn out like that?

I think it is great that we got the CR done and averted a government shutdown (though I wasn’t panicked at all by the potential for a short one, which we’ve had before).

I think that we saw some “changes” in how things will be handled. There was much more use of social media to influence politicians (which I view largely as good, but not without its dangers, as social media tends to be excellent at feeding headlines, but can fail to arouse a lot of attention regarding the details).

I’m not sure that the success of getting this CR through tells us that the Trump administration will have an easy time getting their entire agenda through, which is largely market friendly, and is a big reason why stocks have done so well!

Bottom Line

Be wary on bonds. Nothing from the past few days tells us that there won’t be a lot of spending, just that the direction of the spending will be altered.

Yes, there is some hope of discipline, but the “swamp” seems well entrenched, so I see consistent upward pressure on bond yields (despite the respite in inflation with Friday’s PCE release).

Equities, unclear. The seasonals should be supportive, but we have now had multiple 3% moves in a week (the FOMC down day, and the overnight low to high on Friday). That makes for tricky trading, and I think we are unlikely to see broad-based buying until it becomes more clear what policies are likely to be enacted.

Credit, a touch weaker with equities, but the story for credit remains robust (despite the Fed starting to harp on leverage in their November Minutes). They mentioned leverage by investors, but also in lending, and I assume it will get even more scrutiny in the December minutes and concerns about leverage likely played into their decision to come across as hawkish as they did.

As painful as it might be, watch Bitcoin as it seems about as close to a “pure” signal as we can get on how much of the Trump/Musk (I had to go there) agenda is going to be achievable!

Loading…

Read the full article here