Authored by Lance Roberts via RealInvestmentAdvice.com,

We have spent a lot of time over the last year debunking “narratives,” which are dangerous to investors, as “narratives” create a rationalization for overpaying for assets. Nonetheless, Wall Street loves a simple story and is happy to jump on a trend with momentum, selling products to unwitting consumers. A good example of that lately has been the “weak dollar” narrative, which has pushed investors to chase foreign assets. The negative correlation between a weak dollar and rising international stock exposure appears to be a free return. Unsurprisingly, the story spreads fast because performance charts look clean during a dollar slide.

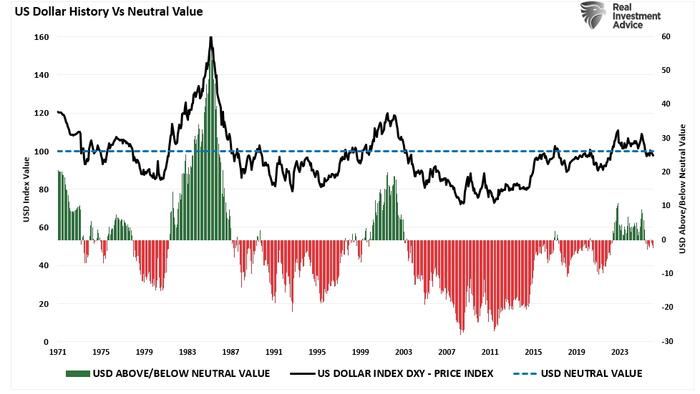

Reuters recently reported that the US dollar hit a four-year low in late January after President Donald Trump said the “value of the dollar” was “great.” Reuters tied the move to rate cut expectations, policy volatility, and concerns about fiscal deficits and central bank independence. However, in reality, President Trump was more correct than not, as Commerce Secretary Howard Lutnick confirmed the dollar trading at a more “neutral level,” as shown below.

There are two very important points to take away from the chart above.

-

The dollar has been in a very strong uptrend since the Financial Crisis and remains there.

-

Despite the recent pullback in the dollar, it is trading at its “Neutral Value” and is at the same level it was in 1970. Such certainly does not support the “debasement” or “demise of the US Dollar” narratives.

What is true is that the decline in the value of the dollar, after its strong surge starting in 2021, does make foreign assets more appealing as investors seek a hedge against a weaker dollar. However, while the “purveyors of perpetual doom” claim this is evidence of the end of the US Dollar dominance, the recent decline in the dollar, as shown above, is simply part of its long history of rallies and declines as the dollar adjusts to flows as foreign governments seek to balance their currencies against the US Dollar.

If you take a look at the dollar chart above, you will notice that it trades in a band above and below 100 (the “neutral value.) This is because the US Dollar is measured against a “basket” of foreign currencies. It is crucial to understand that foreign governments manage their currency against the dollar through a “peg” or a managed band to reduce exchange rate swings and support trade. As such, foreign central banks set a target rate versus the dollar and defend that target by buying or selling dollars from foreign exchange reserves. This is why, when the dollar was “above neutral,” foreign central banks like China reduced their holdings of US Treasuries to strengthen the Yuan.

When demand for the local currency rises, the central bank buys dollars and sells local currency to keep the rate from rising. When demand falls, the central bank sells dollars and buys local currency to keep the rate from falling too much. Many countries also align short-term interest rates, capital controls, and bank liquidity rules with the peg, since rate differentials and hot money flows pressure the exchange rate.

There are several very important reasons why all countries need a stable currency relative to the dollar:

-

It helps exporters price goods with less uncertainty,

-

Supports long-term contracts,

-

Limits imported inflation on energy and commodity prices priced in dollars, and

-

Lowers currency risk for foreign investors.

The trade-off is less monetary policy freedom, greater reserve requirements, and a higher risk of sharp adjustments when the peg level no longer aligns with inflation, growth, or external deficits.

However, none of this supports any commentary about the “death of the dollar,” or the failure of fiat currencies in general. What those commentaries do is push portfolio behavior. When the dollar falls, international stock exposure often rises in the allocation model. The risk lies in the assumption that a weak dollar stays in place indefinitely.

Looking at the chart above, it is clear that currency trends reverse when positioning crowds in either direction. A weak-dollar narrative encourages investors to pay less attention to valuation, earnings, and country-level fundamentals, leaving portfolios exposed when the thesis breaks.

A Potential For A Dollar Rally

Currency markets move on expectations more than anything else. Yes, interest rates, economic growth, and inflation can all impact the dollar, but it is more about the “expectations” of those variables for the dollar, trade, etc., that move the price. Therefore, investors need to be on the lookout for factors that could reverse expectations. Currently, several conditions are forming that could begin to reverse those expectations.

First, positioning and technicals matter. From a long-term technical perspective, the U.S. Dollar Index is attempting to stabilize after a 2025 downside move. As shown, using a 3-year price momentum measure, the dollar is as oversold now as it was at previous dollar bottoms. The current move lower is becoming increasingly stretched, reducing the catalyst needed to trigger a sharp reversal.

A weak dollar trend also encourages leverage through unhedged international stock exposure. As shown, investors have piled into global sector funds (excluding technology) over the past year to boost returns. However, the last time we saw that kind of exposure shift was in 2021, just before the counter-trend rally in the dollar that hit returns fast.

Second, relative economic growth still supports the U.S. over international economies. As we noted previously,

“While investors are exceedingly bullish on the stock market, forecasts for 2026 are sobering. Even the IMF, which recently produced its global growth estimates, has the US economy growing at 2% for the next two years, and the Eurozone near 1%.”.

Relative growth drives capital flows, and capital flows drive currencies. Therefore, when U.S. growth beats expectations while other regions disappoint, the weak-dollar theme loses its power.

Lastly, policy messaging still matters. Reuters reported that Treasury Secretary Scott Bessent reaffirmed “a strong dollar policy.” Furthermore, the expected monetary policy under Kevin Warsh, the new Federal Reserve chairman, is also dollar-bullish. While a single statement does not set a multi-month trend, repeated statements and eventual actions will shift short-term psychology toward a stronger dollar view.

Most crucially, a dollar rally does not require booming U.S. growth. A dollar rally only requires growth and rates to look less negative than they’re priced, and the current oversold conditions lower that hurdle.

The International Valuation Risk

Investors often stack a second argument on top of the weak dollar story. International markets look cheaper than the U.S.; therefore, international stock exposure offers better value. The problem lies in relative valuation, when we should really look at each market’s valuation relative to its own history and earnings path. As shown, when you do that, those markets trade at historically high valuations.

MSCI data shows the MSCI EAFE Index (ex-US) forward P/E at 15.3 as of January 30, 2026. The level looks reasonable in isolation; however, the key issue is what investors receive for that multiple. Given that earnings growth rates, margins, and sector mix are vastly weaker than in the U.S., overvaluation will matter in those countries, just as it does in the U.S.

On the U.S. side, FactSet reported S&P 500 analysts project 2026 earnings growth of 14.1 percent and a forward 12-month P/E of 21.5, below 22.0 at the end of the fourth quarter. The U.S. multiple still sits above long-run averages, yet the direction matters, as the U.S. has cheapened at the margin while earnings expectations have remained resilient and profit margins have improved.

International markets also carry concentration risk. A significant portion of EAFE performance is tied to financials, industrials, and exporters, all of which are sensitive to global trade cycles and demand from China. Those forces can change quickly, but when the weak-dollar narrative drives the trade, investors often ignore the macro risk.

A currency-driven bid also inflates valuation abroad. A weak dollar lifts translated returns and encourages inflows, which in turn raise price multiples. However, when the dollar turns higher, international stock exposure faces a double drag as currency hedging reverses. When that translation turns negative, the valuation premium compresses as flows reverse.

While international stock exposure is fine, and there are certainly periods when it performs better than domestic markets, over the last 17 years it has trailed domestic markets by a large margin. Such is because, at the end of the day, it isn’t about dollar weakness; it is about earnings growth, profit margins, and future expectations. Currently, that growth remains in the U.S.

Investment Tactics Dollar Reversal

As shown, the move in Emerging Market Stocks (EEM) has been extremely sharp, making it much more exposed to a deep reversal if the dollar rallies.

Therefore, investors should treat international stock exposure as a tool, not a narrative. The goal, as always, is to maintain diversification but only to the point where you can control risk. Once it becomes a momentum chase, that risk control fails.

-

Start with position sizing. Set a strategic range for international stock exposure based on your risk tolerance and drawdown limits. Critically, keep that range stable and don’t allow the recent weakness in the dollar to dictate long-term weights.

-

Use rules-based rebalancing. When foreign equities run above target due to a weak dollar surge, trim toward policy weight. When foreign equities lag, add slowly. Rebalancing reduces the damage of an unexpected reversal.

-

Add currency awareness. Consider a split allocation between hedged and unhedged developed exposure. Hedged exposure reduces the impact of a dollar rally, while unhedged exposure keeps diversification benefits when the weak dollar resumes. MSCI publishes a 100% hedged EAFE benchmark that helps investors compare results across hedged and unhedged frameworks.

-

Focus on earnings quality as fundamentals will always matter in the end. Continue to favor markets and sectors with stable cash flows, strong balance sheets, and pricing power, as those traits matter when currencies swing and financial conditions tighten.

-

Avoid valuation shortcuts. Do not rely on “cheaper than the U.S.” Use local history and earnings trends. If international multiples rise while earnings lag, reduce exposure, even if the weak-dollar story remains popular.

-

Finally, stress test the portfolio. Model a 5 percent to 10 percent dollar rally and a 10 percent drawdown in foreign equities at the same time. If the model shows unacceptable damage, reduce unhedged international stock exposure before the market enforces the change.

The weak-dollar narrative is just a narrative, and a reversal will arrive again. That is just how markets operate. The question is whether your process will protect you or hurt you when that reversal comes.

Loading recommendations…

Read the full article here