By Benjamin Pictor, senior market strategst at Rabobank

US equity indices closed in on new highs on Friday as traders look ahead to this week’s FOMC meeting and place bets that monetary conditions are poised to get a little easier. Nevertheless, the US sovereign curve shifted higher by almost 4 basis points, with around half of that move coming after the release of September PCE inflation figures.

The September PCE result was broadly in-line with the expectations of surveyed economists. The headline measure rose 0.3% MoM while the core figure rose 0.2%. That resulted in 2.8% YoY growth for both series. Real personal spending data missed expectations of a 0.1% lift to be flat for the month, supporting the case of the doves leading into this week’s FOMC meeting. A 0.4% lift in August was also revised down to 0.2%, while personal incomes slightly outperformed expectations.

The concurrently-released University of Michigan consumer sentiment index showed overall sentiment rising from 51.0 to 53.3 and a moderating in both short and long-term inflation expectations (even amongst Democrats!). Current conditions fell slightly, while the expectations sub-index surged to 55.0 as respondents’ views of their personal finances seemingly reiterated the signal from the September personal income figures but still remained below levels recorded early in the year. Labor market sentiment improved slightly but remained pessimistic overall to underscore the sense that employment conditions in the USA have been trending worse. The latest JOLTS report to be released on Tuesday will provide further signal on that score.

Friday also saw the release of labor market figures for Canada, which surprised handily to the upside. Net employment grew by 53,600 positions and the unemployment rate unexpectedly fell from 6.9% to 6.5%, having been helped along by a falling participation rate. To put the fall in context, the median expectation of surveyed economists was for unemployment to rise to 7.0%. Consequently, Canadian OIS has followed the Aussie market from implying a small probability of further monetary easing in 2026 to suddenly having a rate by the end of the year fully-priced. Understandably, USDCAD fell by more than a big figure on the day before finding support at 1.3820.

This week will give us a better clue as to what the RBA thinks of the rapid reprice that has occurred in Aussie interest rates over the last month and a bit. The RBA will makes its final policy rate determination for the year on Tuesday, and is widely expected to leave the cash rate unchanged at 3.60%, having cut it three times earlier this year. With growth and inflation resurgent recently, and the labor market still tight by historical standards (albeit trending weaker), market expectations have shifted from having another cut in the first half of 2026 fully priced as recently as the start of November to now having a hike by the end of 2026 fully priced.

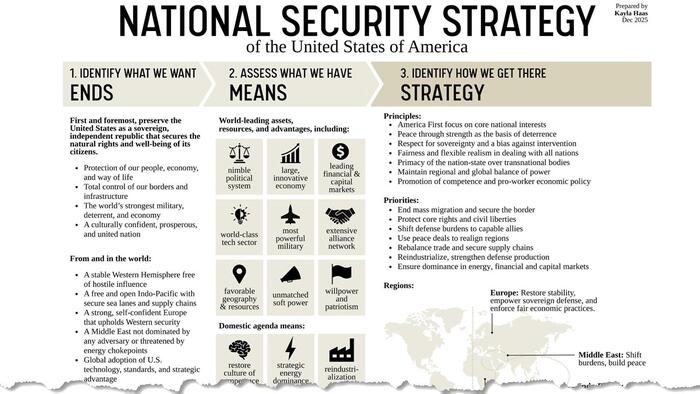

This week’s FOMC meeting and the accompanying release of an updated dot-plot will undoubtedly occupy the bulk of traders’ attention (see our preview here), but the recently released US National Security Strategy deserves staking out the ground that economics and finance is likely to be operating within over the years ahead. We will include a deeper-dive into the strategy and its implications tomorrow, but the broad headlines are US prioritization of the Western Hemisphere through a ‘Trump-corollary’ to the Monroe Doctrine, reindustrialization and energy dominance as elements of national security, maintenance of military dominance and the integrity of the First Island Chain (vis-à-vis China), and – uncomfortably for Europe – support for nationalism over supra-national structures that the US says are subverting democracy and contributing to a lack of civilizational self-confidence.

Tellingly, the document calls for international cooperation on addressing large trade imbalances that have been created by China’s investment-led economy – particularly China’s reliance on external demand to soak up its large exportable surplus of goods, thereby displacing demand for locally-produced goods in other parts of the world (see today’s WSJ for more on that). Explicitly, the document says “America First diplomacy seeks to rebalance global trade relationships. We have made clear to our allies that America’s current account deficit is unsustainable. We must encourage Europe, Japan, Korea, Australia, Canada, Mexico, and other prominent nations in adopting trade policies that help rebalance China’s economy toward household consumption…” For those playing along at home, that means the USA wants you to tariff China.

Of course, some are already doing this. We have seen a number of trade barriers erected between Canada and China, Europe and China, and Mexico and China in recent months. The clear trend is toward more of this as Emmanuel Macron over the weekend told Les Echos that “I told them [China] that if they don’t react [to reduce trade imbalances], we Europeans will be forced to take strong measures… such as tariffs on Chinese products.” Macron contextualised the need for these measures by articulating the existential challenge that European industry faces from competition with China: “China wants to pierce the heart of European industrial and innovation model, which has been historically based on machine tools and the automobile.”

While the US National Security Strategy may make for uncomfortable reading, to a certain extent it is simply a more forthright articulation of problems that many Europeans have already sensed. Clearly, the United States now has a low tolerance for European weakness because the administration in Washington sees that as an emerging threat to the US’s own security.

So, while the USA might want to take a less direct role in the security arrangements of the continent, perhaps we should expect it to take an increasingly direct role in the continent’s political arrangements.

Loading recommendations…

Read the full article here