After a disappointing, subpar, tailing 2Y auction started off the last coupon week of the year, moments ago we got the week’s second auction, a $70BN sale of 5Y paper which was also disappointing.

The auction stopped at a high yield of 3.747%, up from 3.557% in November and the highest since July. It also tailed the When Issued 3.7146 by 0.1bps. This was the 6th tail in the past 7 auctions.

The bid to cover dropped to 2.35 from 2.41 last month; thie was the lost since September and also below the recent average of 2.36.

The internals were also soft, especially at the Indirects: foreign buyers took down just 59.5%, the lowest since September and well below the recent average of 61.8%. The trend is clearly not the 5Y tenor’s friend.

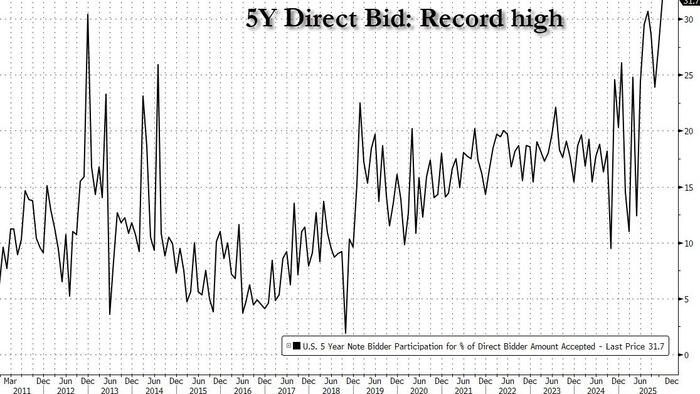

But it was Directs who saved the day: awarded 31.7%, this was the highest on record.

As a result, dealers were left holding 8.8%, tied for the lowest on record.

Overall, this was an ugly, tailing 5Y auction but it could have been even worse had Directs not stepped up. Or maybe they did just because they know that in a few more months the Fed will expand its universe of QE purchases from Bill-2Y all the way to 5Y… and beyond, as Powell gradually shifts to the endgame, which as readers know well, is nothing less than Yield Curve Control.

Loading recommendations…

Read the full article here