Rare earth metals are a set of 17 chemically similar elements which are integral for modern technologies.

From neodymium, used in powerful magnets that can withstand extreme temperatures, to beryllium, which is used to manufacture lightweight materials for fighter jets, these elements have a variety of crucial technological uses.

While rare earth metals are not particularly rare, they are seldom found in pure form and are often mixed with other minerals, making them costly to mine.

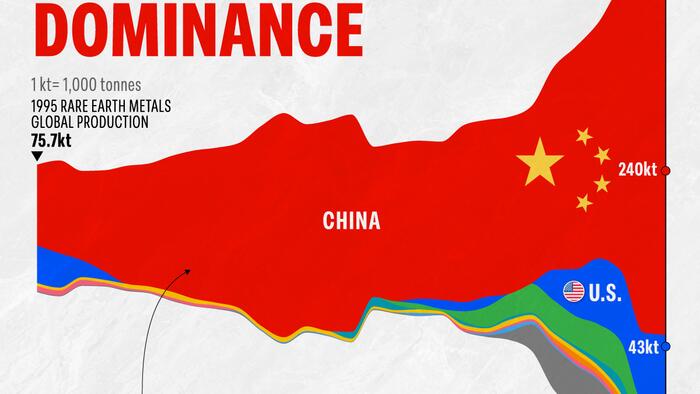

This graphic, via Visual Capitalist’s Kayla Zhu, visualizes rare earth metals production (in kilotonnes) of the eight leading countries from 1995 to 2023, using figures from the Energy Institute’s Statistical Review of World Energy 2024 report.

China Is Dominating Rare Earth Metals Production

Global rare earth metals production has surged the past three decades, increasing from 75.7 kilotonnes in 1995 to over 350 kilotonnes in 2023, reflecting growing demand for these metals in high-tech applications.

China has been and still is the undisputed leader in the rare earth metals industry, accounting for over two-thirds of global production as of 2023.

The United States has made a big comeback in rare earth metals production, particularly from 2017 onwards. U.S. production jumped from 15.4 kilotonnes in 2017 to 43 kilotonnes in 2023, reflecting efforts to strengthen the domestic supply chain and reduce reliance on China.

Separating and processing rare earth metals is an integral step in the supply chain, and China has a near monopoly on this process. The country currently processes 90% of all rare earth metals and 99.9% of heavy rare earth metals, meaning it is importing metals from other countries and processing them.

In December 2023, China banned the export of rare earth metal extraction and separation technology, hoping to reinforce its dominant position when it comes to the global critical minerals supply chain.

Meanwhile, the U.S. has been ramping up efforts to bolster both domestic rare earth metals production and processing capabilities, awarding millions in defense contracts to companies like Lynas Earths and MP Materials to build their own separation and processing facilities.

To learn more about which critical minerals the U.S. depends on China for the most, check out this graphic that visualizes China’s share of U.S. imports by metal.

Loading…

Read the full article here