Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

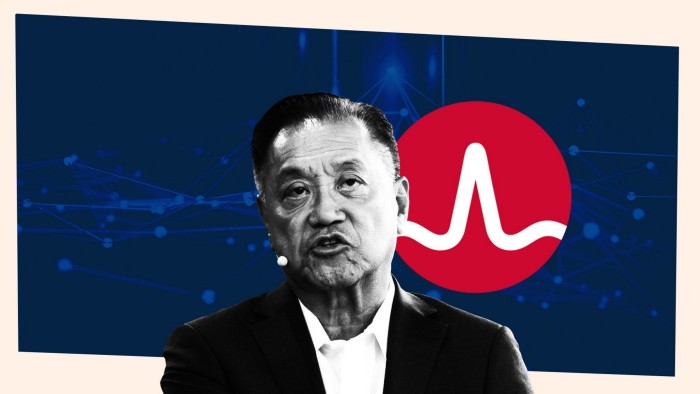

Big Tech’s spending frenzy on artificial intelligence will continue until the end of the decade, according to the head of Broadcom, which has soared to a valuation of more than $1tn on growing investor excitement about its AI chips business.

Hock Tan, Broadcom’s chief executive, told the Financial Times his clients in Silicon Valley were drawing up AI infrastructure investment plans spanning “three to five years in a very big hurry”.

“They are investing full-tilt,” he said. “They will stop when they run out of money or when shareholders put a stop to this.”

Tan’s comments come after Broadcom’s stock price jumped 24 per cent in a single day last Friday, after it revealed that its AI revenues had surged by 220 per cent to $12.2bn in the 2024 fiscal year.

This added more than $200bn to its market capitalisation, vaulting the chipmaker past $1tn in market value for the first time. Tan told investors last week Broadcom could see tens of billions of dollars in additional annual revenue from AI chips by 2027.

Broadcom does not name its chip clients but analysts say the Silicon Valley-based group has worked with Google, Meta and TikTok’s parent ByteDance to design custom processors that accelerate training and deployment of AI systems.

OpenAI and Apple are also reportedly working with Broadcom to develop their own AI server chips, as tech companies seek alternatives to Nvidia, the $3tn chipmaker that dominates the market for the powerful processors needed to train large language models.

Tan’s decades of experience in the semiconductor industry and serial dealmaking have driven speculation in Silicon Valley that Broadcom could step in to rescue Intel, the troubled US chipmaker whose chief executive Pat Gelsinger abruptly left earlier this month.

However, Tan played down the prospect of a Broadcom bid for Intel, saying he had his “hands very full” in AI semiconductors. “That is driving a lot of my resources, a lot of my focus,” Tan said, adding that he had “not been asked” to get involved with Intel.

“I can only make a deal if it’s actionable,” he said. “Actionability means someone comes and asks me. Ever since Qualcomm, I learned one thing: no hostile offers.”

In 2018, Broadcom’s $142bn hostile takeover bid for rival chip company Qualcomm was blocked by then-US president Donald Trump in an unprecedented intervention.

Tan has also been busy completing Broadcom’s integration of last year’s $69bn acquisition of cloud software company VMware. Nonetheless, he said he was “open to potential acquisitions” in either hardware or software: “We are in the considering mode, so to speak.”

This year has seen unprecedented investment by Big Tech companies and AI start-ups such as OpenAI and Elon Musk’s xAI in data centres to create and run ever larger AI models.

xAI’s “Colossus” facility in Memphis boasted 100,000 Nvidia graphics processing units when it came online in September, setting a new bar in the race for AI computing power.

But by 2027, Broadcom’s customers will be building clusters of as many as 1mn AI chips, according to Tan.

Although the “jury is still out” on the value of generative AI to help regular businesses save money, Tan said Big Tech’s “hyperscalers” saw huge opportunities to generate more revenue.

“They need to train [AI] on a scale that the world has hardly ever seen before,” he said. “That consumes huge amounts of silicon. That’s where we show up.”

Much of the recent progress in generative AI has been driven by the so-called scaling law that combining more data with more computing power creates smarter AI.

“They have a formula to keep doing it and they are not at the end of the formula yet,” said Tan. “All roads lead to: you need more computing chips.”

Tech companies are placing “very large bets over three to five years in a very big hurry because they see the technology is in their grasp”, he added. “There are only a few of these players doing that but they are potentially very large consumers [of AI chips] because the returns are enormous.”

Even 1mn chips may not be enough to reach the ultimate goal of OpenAI and rival AI start-up Anthropic: to create artificial general intelligence, or machines that are smarter than humans. “I don’t think anybody knows,” Tan said. “But the opportunity is too hard to resist to say, let’s try it.”

Despite Broadcom joining an elite group of just eight US companies worth more than $1tn, Tan said he felt “nothing new”.

“Value lies in the eye of the beholder. One must learn not to get too hung up on it,” he said. “But it’s great recognition. . . . I guess it’s not just me who believes that generative AI has some more legs to go.”

Read the full article here