Stay informed with free updates

Simply sign up to the Aerospace & Defence myFT Digest — delivered directly to your inbox.

Defence companies are primed for a surge in deal activity as many look to deploy growing cash piles to invest in technologies such as artificial intelligence, sophisticated drones and space systems.

Global conflicts including the war in Ukraine have accelerated the development of new technologies, which is expected to drive dealmaking in the next few years as companies look to expand in fast-growing areas.

The leading 15 defence contractors are forecast to log free cash flow of about $50bn in 2026, according to an analysis by Vertical Research Partners for the Financial Times — almost double their combined cash flow at the end of 2021.

Although larger companies are expected to continue to spend that money on share buybacks and higher dividend payouts, deal activity is also expected to increase.

Michael Sion, partner at consultants Bain & Co, said he expected a pick-up in aerospace and defence M&A, and forecast an influx of funding from private equity and venture capital firms.

“Many companies are looking to expand what they offer to get ready for advanced technologies,” he said. Larger companies, he added, would chase fast-growing parts of defence such as space and defence electronics.

Meanwhile, the value of venture capital deals in the defence sector has increased 18-fold in the past decade, according to a new report by Bain. Growth has been driven in part by an increasing convergence of commercial and defence technologies.

Many investors, in particular in Europe, have also been wary of backing the sector over ethical concerns but attitudes are changing following Russia’s invasion of Ukraine almost three years ago.

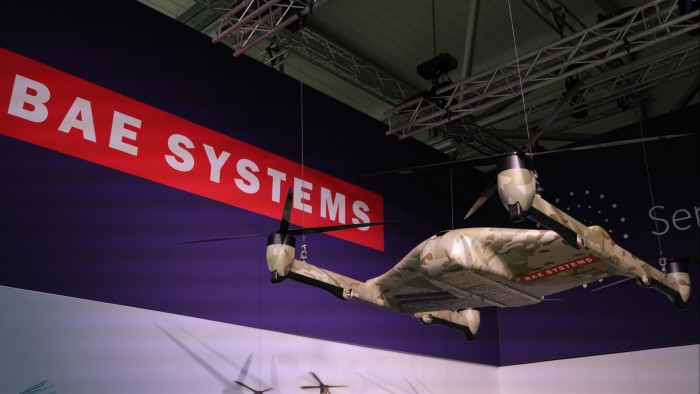

Recent corporate deals in the industry include BAE System’s acquisition of Ball Aerospace, a US-based supplier of mission-critical space systems, for $5.6bn, which was announced in 2023. US defence prime L3Harris agreed to buy rocket engine maker Aerojet Rocketdyne at the end of 2022.

In November, drone manufacturer AeroVironment said it would acquire BlueHalo, a company known for its drone swarm and counter-drone technology, for about $4.1bn through an all-share transaction. Wahid Nawabi, chief executive of AeroVironment, said the company planned to be a “next generation” prime contractor which would be focused on “defence technology”.

In a recent Financial Times interview Nawabi said he wanted to create a company that did “all the things that the [US] Department of Defense is focused on and needs”. That included, he said, “unmanned systems, loitering munitions, space communications . . . electronic warfare and cyber security”.

There was “likely to be activity in what you might call the ‘defence technology’ space such as drones, AI and lasers”, said Robert Stallard, analyst at Vertical Research Partners. But consolidation at the top end of the sector among the large prime contractors was unlikely, he added.

Even with an “‘anything goes’ Trump Department of Justice, the US defence industry is super consolidated at the prime level”, Stallard said.

In Europe, meanwhile there “should be consolidation and M&A, but getting governments to agree is another thing altogether”, said Stallard.

Joint ventures and teaming are a “much easier step, allowing the Europeans to pool forces without getting politicians animated over loss of sovereign capability”.

Bain’s Sion said given the modernisation needs of the defence industry, there was an opportunity for private capital to play a larger role. Private capital, he said, can help to plug a “funding gap” between US defence requirements and defence budgets.

It can help to solve some of the “challenges of the defence industrial base”, such as “capacity growth, improving operations and delivery,” he added.

Read the full article here