Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

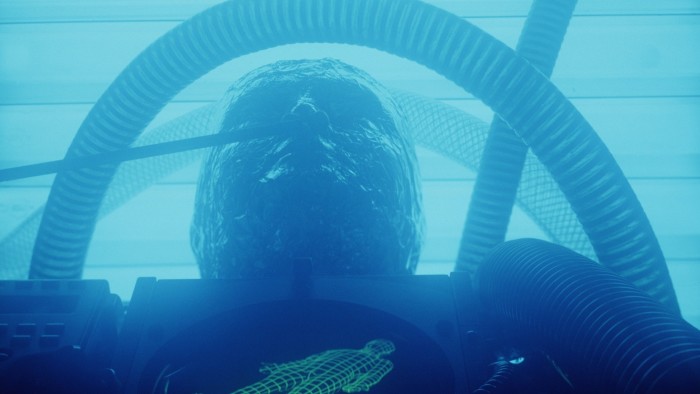

What price immortality? Hal Finney, a computer scientist and early bitcoin user, placed his bets on cryonics: his body is preserved at Alcor Life Extension Foundation in Arizona. Tech billionaire Bryan Johnson has availed himself of his son’s youthful blood.

The multibillion-dollar longevity industry, a coven of snake oil merchants, biohackers and geniuses, is tricky to quantify. Estimates vary hugely, depending whether you include disease-specific or other therapies. But the roll-call of backers — and users — reads like a 21st century who’s who of Silicon Valley.

Tech billionaire Peter Thiel and Google chief engineer Ray Kurzweil are signed up with Alcor (member benefits: “possible revival”). Amazon founder Jeff Bezos and Moscow-born Israeli tech entrepreneur Yuri Milner are reportedly backing Altos Labs, which aims to rejuvenate cells and thereby prolong life. Calico Labs, also focused on extending human lives, was birthed by Google.

Humans have wanted to live forever since the dawn of time, but the industry now stands on the brink of a “critical decade”, reckons Laura Deming, who founded The Longevity Fund, a VC firm. On one path, breakthrough to the mainstream. On the other, isolated silos in a kind of busted flush.

Either way, the chances are that immorality is not going to come in our time. Current generations’ ability to monetise it — geeky multibillionaires notwithstanding — looks only slightly less elusive. Genomics group Human Longevity failed to deliver on its planned listing via a Spac. Peers, big on bold mission statements, have been slower to deliver.

Many start-ups lack proof of concept, never mind a pathway to profitability. The legal and regulatory infrastructure is threadbare at best. One glaring example: because ageing is not regarded as a disease, the FDA cannot approve anti-ageing drugs. Trials pose another problem: how long before a guinea pig can claim to have beat ageing? There is not even a well-defined and universally agreed biomarker that actively defines ageing.

That has not stopped a rash of start-ups in the field raising $430mn of venture capital in the first nine months of the year, according to Crunchbase. BioAge Labs, which targets the biology of ageing, pulled in just shy of $200mn when it listed on Nasdaq in September.

The Longevity Fund is just one of a pack, although fewer are pure plays on anti-ageing. Such is the case with Bayer’s $1.9bn-plus Leaps fund, which inevitably has its own ROI metric, Wellbeing Adjusted Life Years (Waly), quantifying the impact events have on wellbeing.

As a life goal, healthy immortality has plenty of appeal. For now, however, it is less attractive as an investment proposition.

Read the full article here