Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer, a former FT editor, is head of industrial policy at Policy Exchange

With the semiconductor trade war between the US and China showing no sign of easing, other semiconductor-producing countries are trying to avoid collateral damage. In Japan, the world leader until it was overtaken by South Korea and Taiwan, the government is backing a new venture based on a novel technology for developing the most advanced chips. The EU is pressing ahead with a programme of investment in fabrication plants, partly funded by national governments under the European Chips Act.

What should the UK be doing? This is a question that could usefully be examined by the government’s new industrial strategy council, whose membership has recently been announced.

In Arm, the country has one of the world’s most highly valued semiconductor companies, albeit one that is majority owned by Japan’s SoftBank. Its share price has risen rapidly in recent months because of its expected role in artificial intelligence applications. But Arm is a licenser of intellectual property, not a manufacturer. It is on the manufacturing side of the industry that the UK has lagged behind.

Because of decisions taken by governments and companies over the past 40 years, the UK does not have a large, broad-based semiconductor maker comparable to the three European leaders — Infineon in Germany, NXP in the Netherlands and the Franco-Italian partnership STMicroelectronics.

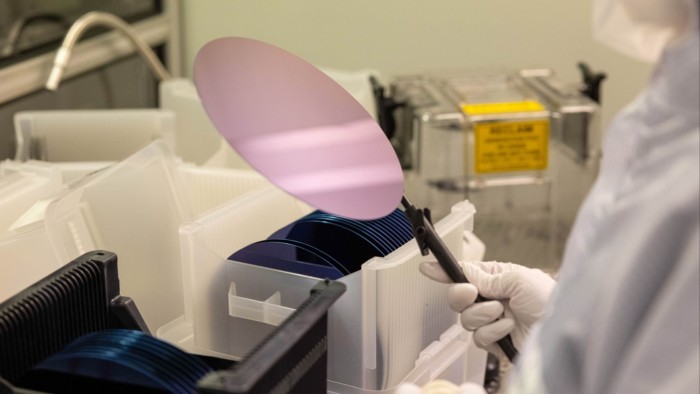

Britain’s semiconductor manufacturing industry is small and most plants cater to niche markets. A significant new entrant is Vishay, a US electronic components maker that bought what used to be known as Newport Wafer Fab, in south Wales. Unlike previous owner Nexperia, which made silicon chips there, Vishay plans to use it as a production centre for silicon carbide and gallium nitride chips. These are compound semiconductors that because of their low power consumption and other advantages have been gaining ground over silicon, especially in automotive and industrial markets.

Compound semiconductors currently account for about 20 per cent of total semiconductor demand. It is a sector in which UK-based companies have invested on a substantial scale in recent years, supported in some cases by government research grants. Plessey Semiconductors in Plymouth, which makes micro display chips based on gallium nitride, is one example. In south Wales, the compound semiconductor cluster is made up of several companies, some foreign-owned, which develop and manufacture compound semiconductors for industrial customers. Vishay’s presence in Newport should give the cluster a useful boost.

Given the sector is expanding fast, new applications are emerging, and it is not dominated by large Asian or US companies, compound semiconductors represent an opportunity for the UK. There is no lack of promising ideas coming out of universities, and the country has a vibrant design sector active in this field.

What is needed for these ideas to be turned into products is the creation of an open-access foundry. This could play the same sort of role for compound semiconductors in serving companies that do not have their own fabrication capacity as silicon-based foundries do in Europe and elsewhere. It could be built on a greenfield site or adjacent to an existing fabrication plant. Some of the funding would almost certainly have to come from the government. One could imagine a consortium of semiconductor companies and private investors financing two-thirds of the project, with the rest coming from the state.

As recent events have shown, semiconductors are too important, in economic and strategic terms, for the government not to have a clear plan for the industry. A focus on compound semiconductors provides a possible way forward.

This article is based on the author’s Policy Exchange paper, ‘Semiconductors: a test for the new government’

Read the full article here