The cryptocurrency market capitalization is down today, with the U.S. Securities and Exchange Commission (SEC) spoiling the rally this week.

SEC delays spot Bitcoin ETF applications

The combined valuation of all cryptocurrencies has fallen 3.7% in the last 24 hours to $1.02 trillion on Sep. 1.

Bitcoin (BTC), which makes up nearly half of the crypto market, lost 4.5% in the last 24 hours. The selloff started after the SEC postponed its decision on six spot Bitcoin ETF applications, including BlackRock’s, until October.

The losses remained intact as Bitwise, one of the Bitcoin ETF applicants, withdrew its application after the SEC delay.

The crypto market has been eagerly waiting for the SEC to approve a Bitcoin ETF in the U.S., under the impression that it would attract institutional investors and, in. turn, bring more capital into the crypto sector.

On Aug, 29, the crypto market and BTC price rallied over 5% after a federal court directed the SEC to reconsider the crypto asset manager Grayscale Investments’ application to launch a Bitcoin ETF.

These gains are now wiped out.

Long liquidations outweigh shorts

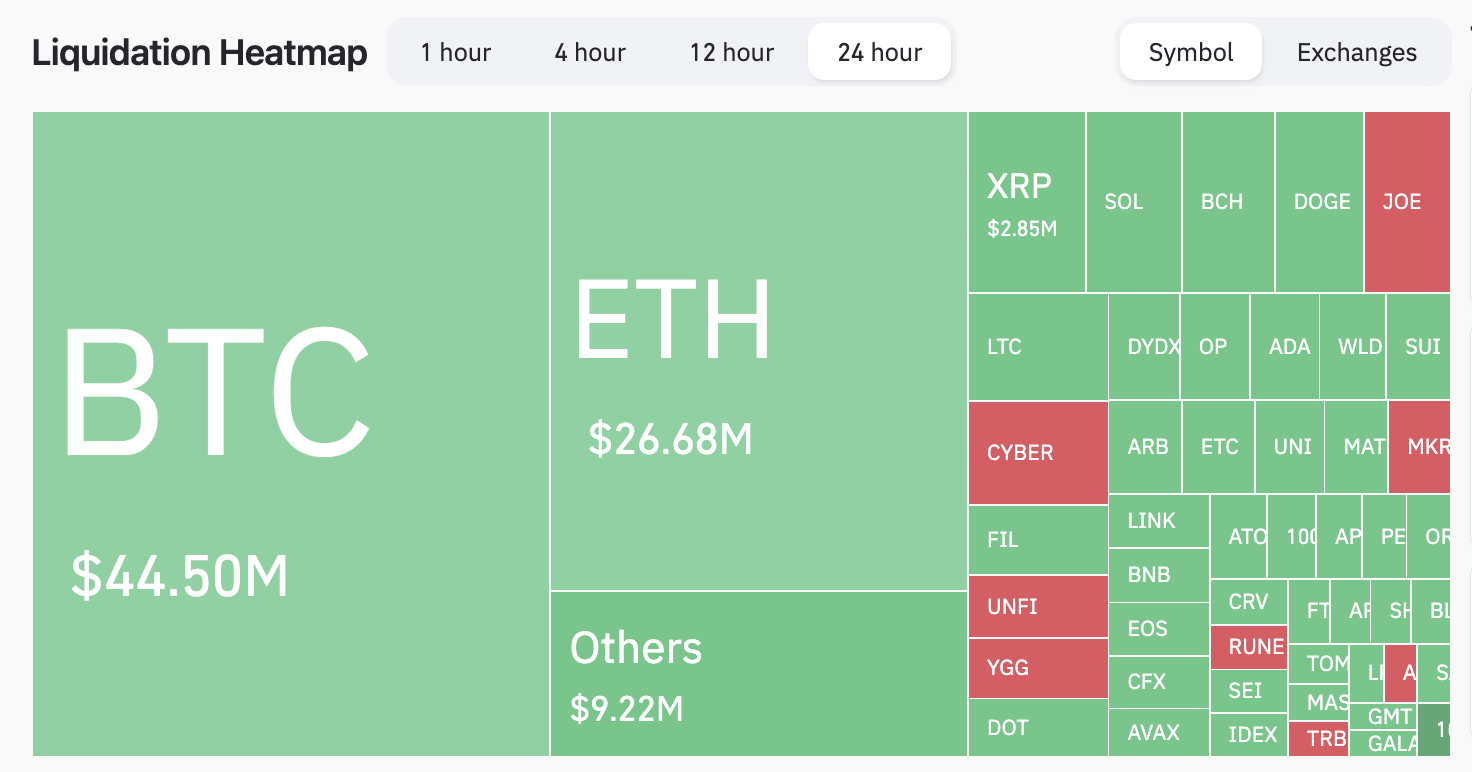

Bitcoin’s losses in the last 24 hours further coincide with massive long liquidations in the same timeframe.

Related: Bitcoin risks ‘swift’ $23K dive after BTC price loses 11% in August

Notably, the crypto derivatives market has closed $106.32 million worth of long positions in the past 24 hours. In comparison, only around $16 million of short liquidations happened in the same period.

Long liquidations involve exchanges selling traders’ initial margin to keep themselves from losing funds that the traders have borrowed. Simply put, they sell Bitcoin, for example, to cover the borrowed amount, increasing the selling pressure in the process.

Dollar’s recovery battering crypto since July

A stronger U.S. dollar is also a big reason for the crypto market’s slump thanks to their consistent negative correlation with one another in 2023.

Related: Bitcoin risks ‘swift’ $23K dive after BTC price loses 11% in August

Notably, the U.S. dollar index (DXY), which measures the greenback’s strength against the weight of top foreign currencies, has risen 0.75% since Aug. 31. Meanwhile, its daily correlation coefficient with the crypto market stands near -0.78.

The DXY has been in an uptrend since early July when Bitcoin marked its yearly highs of around $31,000.

Crypto market outlook for September 2023

From a technical standpoint, the crypto market treads near its long-serving ascending trendline support, eyeing a rebound toward $1.058 trillion in September. The recovery target coincides with the market’s May-June 2023 support line and descending trendline resistance.

Conversely, a decisive break below the ascending trendline support could send the crypto market valuation crashing toward the $950-975 billion area (the red bar in the chart above).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here